What is stagflation?

Stagflation or what is also known as “recession-inflation” is continued high inflation combined with high unemployment and stagnant demand for goods and services because of their high prices in a country’s economy. The term was coined in 1965 by British politician Iain Macleod. It is seen as a rare event. However, stagflation has been persistent […]

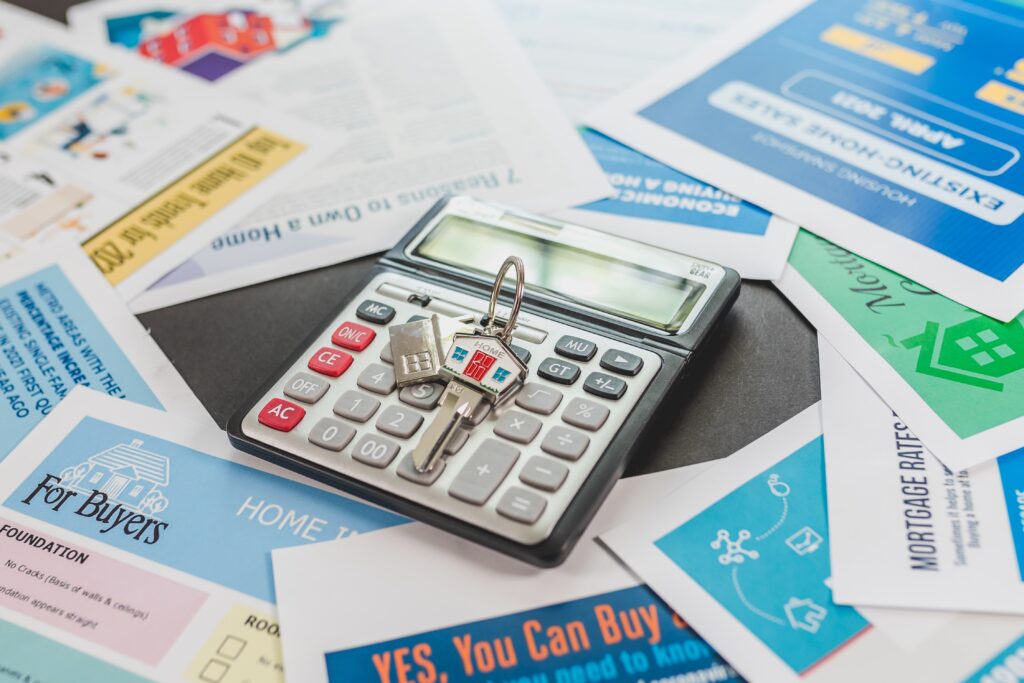

What is a mortgage recast?

A mortgage recast is when your lender recalculates the monthly payments on your current loan based on the outstanding balance and remaining term. Keep in mind that recasts are not automatic and aren’t offered by all lenders. Mortgage recasts might be a good idea if you received a large windfall of money and applied it […]

What is a Community Property State?

In community property states, spouses are considered joint owners of nearly all assets and debts acquired in marriage. However, most states follow common law which allows spouses to own property individually. The type of law your state follows dictates how property is divided upon divorce or death. Under common law, if someone is the only […]

What is a lender overlay?

Lender overlays are additional requirements put in place by a lender above and beyond those set by Fannie Mae, Freddie Mac, VA, USDA, and FHA. Essentially lender overlays make the mortgage approval process more restrictive for borrowers, but at the same time makes borrowing and the mortgage market safer for all. These overlays can come […]

Which is better? A Pre-Qualification or a Pre-Approval

A pre-qualification means your lender has reviewed the financial information you provided and deems you qualified for a mortgage. This qualification is typically done based on what a borrower tells the lender and usually doesn’t involve hard documents. A Pre-approval typically involves the review of hard documents, running the borrower’s credit, completing a loan application, […]

How does amortization work?

Basically, amortization is a repayment feature on loans with equal monthly payments that have a fixed end date or term. Not just mortgages, but car loans also operate this way. As a borrower it’s always a great idea to obtain what’s called an amortization table before obtaining this type of loan. Your lender can provide […]

What is the TILA / RESPA Integrated Disclosure Rule?

To break it down, TILA stands for the Truth in Lending Act and RESPA stands for the Real Estate Settlement Procedures Act. The TILA/RESPA integrated disclosure rule or “Know before you owe” as it is sometimes referred to began October 3, 2015 and was created in order to harmonize and consolidate disclosures and regulations. It […]

What is a short sale?

A short sale is when a financially distressed homeowner sells their property for less than they owe on the mortgage. This process is completed before the lender would seize the property in a foreclosure proceeding. The critical thing to remember is that in a short sale all proceeds go to the lender. Essentially, when a […]

What’s a Deed-in-Lieu of Foreclosure?

A deed in lieu of foreclosure is when the borrower hands the deed of the property over to the mortgage company in an effort to avoid foreclosure proceedings. Foreclosures can wreck havok on a borrower’s credit report and can make it almost impossible to get another mortgage in the short term. However a deed-in-leiu of […]

What are the different types of Adjustable Rate Mortgages (ARMs)?

There are basically six different types of ARM, adjustable rate mortgages, that you will see being offered by most lenders. Essentially they fall into 5, 7, or 10 year fixed rate options with the remainder of the term having a fluctuating interest rate. With each of these three fixed term periods, you can have a […]